Image source: https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj9oRYj4ZxC1X5R31fj7emlefPxzpw90u5J-WRZngtsBd4-hjF6iCR770q7ZhwaCpPcZ_97D4gKGfAVQ7ua0i_PtjHbGqevjiAKcw_fEJAIRRaJkeyAuAwa1fdsCFD9CeuZ49kXNdNDrEE/s1600/bin.jpg

What Is Your Money Blueprint

All of us have a personal money blueprint ingrained in our subconscious minds that will determine our financial lives.

Have you ever wondered why some people seem to get rich easily, while others are destined for a life of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or their choice of jobs, businesses or investments?

The shocking answer is none of the above!

No doubt youve read other books, listened to tapes or CDs, gone to courses and learned about numerous money systems, be they in real estate, stocks or business. But what happened? For most people, not much! They get a short blast of energy, and then its back to the status quo.

Finally, theres an answer. Its simple, its law, and youre not going to circumvent it. It all comes down to this: If you subconscious financial blueprint is not set for success, nothing you learn, nothing you know and nothing you do will make much of a difference. Ill explain more about this later.

My Obsession with Becoming a Success

Like many of you, I supposedly had a lot of potential but had little to show for it. I read all the books, listened to all the tapes and went to all the seminars. I really, really, really wanted to be successful. I dont know whether it was the money, the freedom, the sense of achievement or just to prove I was good enough in my parents eyes, but I was almost obsessed with becoming a success.

After leaving college after my first year, I spent the next 12 years trying to make ends meet. Any money I made, I lost. I really couldnt rub two nickels together. I thought that I was fairly intelligent and a good person, and I couldnt understand why the one thing that I wanted, financial success, completely eluded me.

Then, as luck would have it, I got some advice from a rich friend of my father, a wealthy man in many ways. He was a strongly principled person who had a really big heart. He said to me, Harv, if you want to be successful at business, you need to do what successful business people do. Rich people think the same thoughts and take similar actions, albeit in different vehicles. So by reading, studying and modeling them you can pick up what they do.

It was time to put what I learned to the test. I opened my next business, which was one of the first retail fitness stores in all of North America. And using the principles I learned, I became a millionaire in only two and a half years. The business was so successful that I opened 10 stores in that time alone.

After selling the company, I took a few years off to refine my strategies and began doing one-on-one business consulting. And today, my sole mission is to teach these same principles to people throughout North America via my Millionaire Mind Seminar program.

I would like to share with you a little about how each of us is conditioned to think and act about money. Ill help demystify for you why some people are destined to be rich and others are destined for a life of struggle. Youll understand the root causes of success, mediocrity or financial failure and begin changing your financial future for the better.

What is your Money Blueprint?

One of the things I say in my book Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth, as well as on radio and television is, give me five minutes with anyone and I can predict their financial future for the rest of their life. How? By identifying their money blueprint.

Each of us has a personal money blueprint already ingrained in our subconscious mind that will determine our financial life. What that means is you can know everything about business, marketing, communications, negotiation or real estate, for example, but if your subconscious money blueprint isnt preset to a high level of success, you will never amass a large amount of money.

Weve all heard of Donald Trump and what he has accomplished. Here is this multibillionaire who at one point lost everything, and within two years hes got it all back and more. Why? His money blueprint is set for high. On the other side of the coin we have lottery winners. They win millions of dollars and within five years virtually half of them are back where they started. Why? Their money blueprint is set for low.

How your Money Blueprint is Formed

What people have to realize is that we are all taught and conditioned in how to deal with money. Unfortunately, many of us were taught by people who didnt have a lot of money, so their way of thinking about money became our natural and automatic way to think.

Your mind is nothing more than a big and spacious storage cabinet. In this mental file cabinet you file and store information. Where does this information come from? It comes from your past programming. Your past programming determines every thought that forms in your mind.

So the questions becomes, How are we conditioned? We are conditioned in three primary ways in every arena of life, including money:

The first influence Verbal programming: What did you hear when you were young?

The second influence Modeling: What did you see when when you were young?

The third influence Specific incidents: What did you experience about money, success and rich people when you were young?

The First Influence: Verbal Programming

Did you ever hear phrases like, Money is the root of all evil. Save your money for a rainy day. Rich people are greedy. Rich people are criminals. filthy riches. You have to work hard to make money. In my household, every time I asked my father for any money Id hear him scream, What am I made ofmoney?

Every statement you heard about money when you were young remains lodged in your subconscious mind as part of the blueprint that is running your financial life. Naturally, you dont even have to think about it. You dont even see it. You go to your money file, pick it out and do what youre supposed to do with it. Thats because your subconscious conditioning determines your thinking. Your thinking determines your decisions, and your decisions determine your actions, which eventually determine your outcomes.

The Second Influence: Modeling

The second way we are conditioned is called modeling. There is a saying, Monkey see, monkey do. And, of course, human beings are not far behind. Generally, we will tend to be exactly like one or a combination of both of our parents in the arena of money.

So the question is, what were your parents like around money when you were growing up? Did they manage money well or did they mismanage it? Were they spenders or were they savers? Were they shrewd investors or were they non-investors? Was money always a struggle in your home or was it a source of joy and ease? Whatever your answers, you will be very similar to that. Although most of us would hate to admit it, theres more than a grain of truth in the old saying, The apple doesnt fall far from the tree.

On the other side of the coin, some of us are exactly the opposite of one or both parents when it comes to money. Many people who come from poor families become angry and rebellious about it. Often they either go out and get rich or at least have the motivation to do so. But theres one little hiccup. Whether such people get rich or work very hard trying to become successful, they usually arent happy. Why? Money and anger become linked in their minds, and the more money such individuals have or strive for, the angrier they get.

The reason or motivation you have for making money or creating success is vital. If your motivation for acquiring money or success comes from a nonsupportive root such as fear, anger or the need to prove yourself, your money will never bring you happiness.

The Third Influence: Specific Incidents

The primary way we are conditioned is by specific incidents. What did you experience when you were young about money, wealth and rich people? These experiences are extremely important because they shape the beliefs or rather, the illusions you now live by.

Let me give you an example. A woman who was an operating room nurse attended the Millionaire Mind Intensive seminar. Josey had an excellent income, but somehow she always spent all of her money. When we dug a little deeper, she revealed she remembers when she was 11 being at a Chinese restaurant with her parents and sister. Her mom and dad were having yet another bitter argument about money. Her dad was standing up, screaming and slamming his fist on the table. She remembers him turning red, then blue, and then falling to the floor from a heart attack. She was on the swim team at school and had CPR training, which she administered, but to no avail. Her father died in her arms.

Since that day, Joseys mind linked money with pain. Its no wonder, then, that as an adult, she subconsciously got rid of all of her money in an effort to get rid of her pain. Its also interesting to note that she became a nurse. Why? Is it possible she was still trying to save her dad?

What is Your Money Blueprint Set For?

Now its time to answer the million-dollar question: What is your current money and success blueprint, and what results is it subconsciously moving you toward? Are you set for success, mediocrity or financial failure? Are you programmed for struggle or for ease around money? Are you set for working hard for your money or working in balance? Are you set for having a high income, a moderate income or low income? Are you programmed for saving money or for spending money? Are you programmed for managing your money well or mismanaging it?

As I stated earlier, your money blueprint will determine your financial life and even your personal life. If youre a woman whose money blueprint is set for low, chances are youll attract a man who is also set for low so you can stay in your financial comfort zone and validate your blueprint. If youre a man who is set for low, chances are youll attract a woman who is a spender and gets rid of all your money, so you can stay in your financial comfort zone and validate your blueprint.

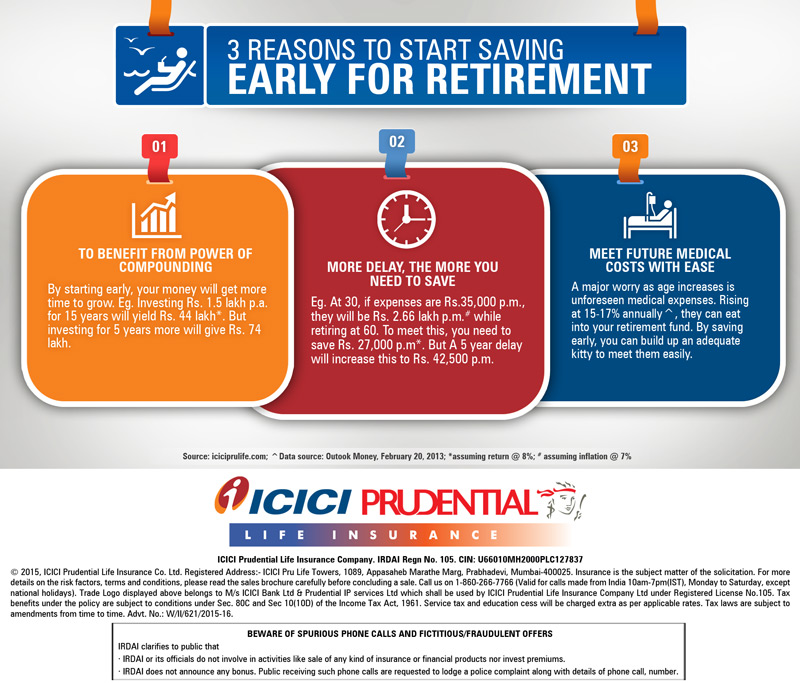

So again, how can you tell what your money blueprint is set for? One of the most obvious ways is to look at your results. Look at your bank account. Look at your income. Look at your net worth. Look at your success with investments. Look at your business success. Your blueprint is like a thermostat. If the temperature of the room is 72 degrees, chances are good that the thermostat is set for 72 degrees.

The Roots Create the Fruits

The only way to significantly change the temperature in the room is to reset the thermostat. In the same way, the only way to change your level of financial success permanently is to reset your financial thermostat, otherwise known as your money blueprint.

In life, our fruits are called our results. So what do we tend to do? Most of us focus even more attention on the fruits, our results. But what is it that actually creates those fruits? The seeds and the roots, thats what.

Whats under the ground creates whats above the ground. Whats invisible creates whats visible. So what does that mean? It means if you want to change the fruits, you will first have to change the roots. If you want to change the visible, you must first change the invisible.

In every forest, on every farm, in every orchard on Earth, whats under the ground creates whats above the ground. Thats why focusing your attention on the fruits youve already grown is futile. You cannot change the fruits already handing on the tree. You can, however, change tomorrows fruits. But to do so, youll have to dig below the ground and strengthen the roots.

/about/GettyAccounting-56aa2e725f9b58b7d0019903.jpg)