Image source: https://cdn.static-economist.com/sites/default/files/images/print-edition/20170128_FBC665.png

The opportunities for stock investment is not only limited to the stock markets of your home country. With the increasingly easier access to foreign economies, buying shares of international companies is now a practical option you can consider as part of diversifying your portfolio. It is also an opportunity to take part in booming economies and faster-growing stock markets.

Like any other investment venture, investing abroad has its own set of benefits and risks. They key is to consider the pros and cons and evaluate if this fits your risk tolerance as an investor. Most investors who venture beyond their home countries are high net worth individuals who have a fund surplus after investing in local stocks, bonds, mutual funds, real estate, etc. Buying foreign shares is not limited to rich investors though. You can start with just $500 and build from there if you later decide that international stock markets suit your portfolio.

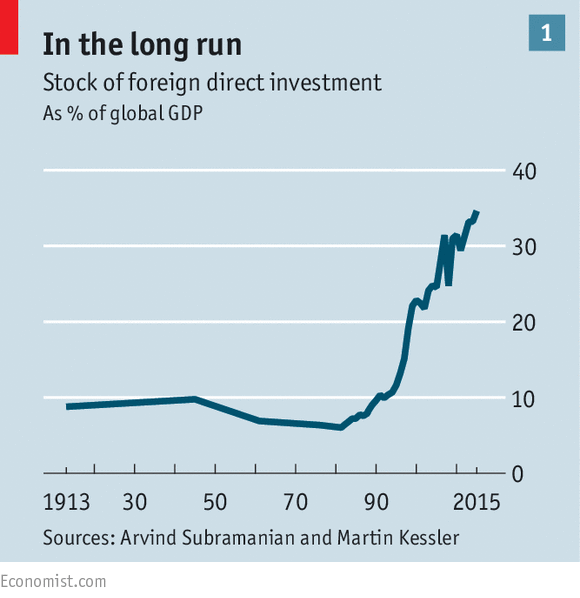

One advantage of foreign stock markets is the low correlation they may have with your local market. This means that when the local market is down, the foreign market may be up. In today's globalized economy, that may not always be the case since markets tend to move in sync. For instance, the stock markets of developing countries that depend on the United States for imports and exports are significantly affected by movements in the US markets. However, studies have shown that in the long term, foreign markets are fairly independent of each other.

Another benefit of investing abroad is your exposure to rapidly developing industries that may not available in your own country. If you are an investor in the US market for instance, you're missing out on the top makers of steel and electronic appliances which are not based in the US. Analysts also say that emerging stock markets in China, southern Europe, and southeast Asia have a faster growth rate than the established markets in the US and United Kingdom.

A serious risk, of course, is the political and economic upheavals that foreign countries may experience which could lead to a damaging crash in the stock markets. The differences in market regulations and standards could also be a difficulty especially when it comes to evaluating foreign companies.

Another risk of international investment is the volatility of exchange rate movements. If the foreign currency falls in value, then your investment return also suffers despite the gains your stocks may have made in the market. Countries which devalue their currencies are also dangerous pitfalls for foreign investors. You could incur losses practically overnight.

The massive growth potential of emerging markets has been mentioned earlier but with this faster growth rate comes higher risks. Stock markets in developing countries are generally more volatile than the mature markets of more developed economies. If you would rather be on safer ground, then invest in stock markets of more stable countries.

Investing in depositary receipts (DRs) is one way of accessing foreign markets while minimizing the risks. DRs are financial securities issued by foreign companies which are traded on your local market. These companies release financial reports that conform to the Securities and Exchange Commission regulations of your home country, thus making it easier for you to evaluate them. Although DRs are traded like local stocks, they still generally adhere to the behavior of the foreign shares they represent.

Investing in international markets may have its own pros and cons but it is still a viable addition to your stock portfolio.